What is an open-end mortgage? In the ever-evolving landscape of real estate financing, innovative mortgage options continue to emerge, offering borrowers greater flexibility and financial control.

Among these alternatives, the concept of an open-end mortgage stands out as a dynamic and versatile approach to home financing.

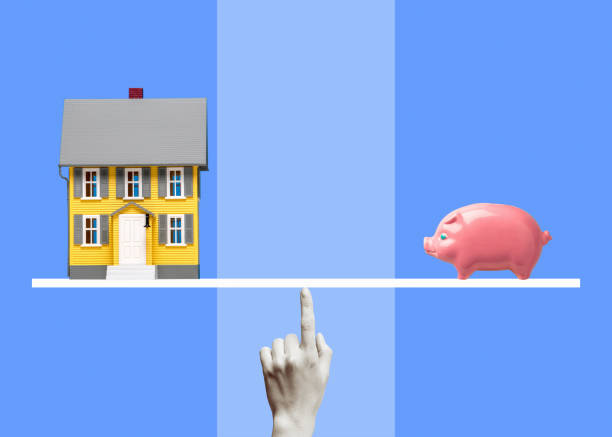

An open-end mortgage is a specialized loan arrangement that allows homeowners to access additional funds beyond the initial loan amount, providing a level of financial agility that traditional closed-end mortgages cannot match.

This article delves into the fundamental aspects of open-end mortgages, shedding light on their defining features, benefits, and implications for both borrowers and lenders.

By exploring the intricacies of this mortgage type, readers will gain a comprehensive understanding of how open-end mortgages work and how they might reshape the way individuals navigate homeownership and financial management.

Also Read:

What Is a Mortgage Banker? (All You Should Know)

What Is a Mortgage Buyback? (All You Should Know)

What Is an Open-End Mortgage?

An open-end mortgage is a dynamic form of home financing that offers borrowers the unique ability to access additional funds from their mortgage beyond the initial loan amount.

Unlike traditional closed-end mortgages, which provide a fixed loan amount with set repayment terms, open-end mortgages provide a revolving line of credit secured by the property.

This means that as borrowers make payments towards the principal balance, they regain access to those paid funds, effectively allowing them to borrow again without the need for a new loan application.

The flexibility of open-end mortgages grants homeowners greater control over their finances, enabling them to cover unexpected expenses, renovations, or other financial needs without the complexities of securing new loans.

Interest is generally calculated only on the outstanding balance, and borrowers can choose how much of their credit line to use at any given time.

However, this flexibility also requires disciplined financial management to avoid overextending credit.

Open-end mortgages find similarities with home equity lines of credit (HELOCs), yet they are secured by the mortgage itself rather than the accumulated equity in the property.

Lenders assess factors such as the property’s value, the borrower’s creditworthiness, and repayment history to determine the credit limit.

While open-end mortgages offer considerable advantages in terms of financial agility, borrowers must carefully evaluate their financial capabilities and long-term goals before opting for this mortgage type.

How Open-End Mortgages Differ from Traditional Mortgages

Open-end mortgages diverge significantly from traditional closed-end mortgages in their structure and functionality.

A closed-end mortgage provides a fixed loan amount, usually for a specific purpose like home purchase or refinancing, with a predetermined repayment plan.

In contrast, an open-end mortgage introduces a dynamic element by offering a revolving line of credit secured by the property.

This means that borrowers can access additional funds from their mortgage beyond the initial loan amount, akin to a credit card but backed by the property.

Unlike closed-end mortgages with set repayment terms, open-end mortgages allow borrowers to repay and borrow funds repeatedly within an agreed-upon credit limit.

As payments are made towards the principal balance, the available credit increases proportionally, enabling borrowers to tap into their equity without the need for additional loan applications.

This flexible borrowing feature makes open-end mortgages ideal for covering ongoing expenses, renovations, or unforeseen financial needs.

Furthermore, open-end mortgages often calculate interest based only on the outstanding balance, potentially leading to lower interest costs compared to traditional mortgages.

However, this flexibility demands responsible financial management to avoid overborrowing.

Borrowers must also consider that open-end mortgages might have slightly higher interest rates and fees due to their unique benefits.

Overall, while traditional closed-end mortgages offer stability and predictability, open-end mortgages introduce a new level of financial freedom by providing ongoing access to funds based on the property’s equity, potentially transforming how homeowners address their financial needs.

Steps to Apply for an Open-End Mortgage

Applying for an open-end mortgage involves several crucial steps that borrowers should navigate with careful consideration.

- Research and Preparation: Understand the concept of open-end mortgages and assess your financial needs. Research different lenders that offer this mortgage type and gather relevant information.

- Credit and Financial Assessment: Lenders will evaluate your credit score, income, debt-to-income ratio, and other financial aspects. A strong credit profile enhances your chances of approval and favorable terms.

- Property Valuation: Lenders typically appraise the property to determine its current market value, which influences the credit limit you’ll be offered.

- Loan Application: Complete the lender’s application form, providing accurate and comprehensive information about your financial situation, employment history, and the property.

- Documentation: Gather necessary documents such as tax returns, pay stubs, bank statements, and property-related documents to verify your financial details.

- Underwriting Process: The lender reviews your application and documents, assessing your eligibility for an open-end mortgage based on their criteria.

- Credit Limit Determination: Once approved, the lender establishes your credit limit, reflecting the equity in the property and your financial qualifications.

- Agreement Review: Carefully review the terms and conditions of the open-end mortgage agreement, understanding interest rates, fees, repayment options, and any potential limitations.

- Signing and Closing: Sign the agreement and complete the closing process, which involves legal documentation and finalizing the loan terms.

- Accessing Funds: As the mortgage is established, you can begin accessing funds within the credit limit. Repayments will replenish your available credit.

- Financial Management: Responsible financial management is essential. Borrow only what you need, make timely payments, and monitor your credit limit to avoid overborrowing.

- Regular Review: Periodically assess your financial situation and the mortgage terms to ensure they align with your changing needs and goals.

Navigating these steps diligently helps secure an open-end mortgage that aligns with your financial objectives while utilizing the flexibility it offers to manage your finances more effectively.

Also Read:

How to Remove Escrow Account from Mortgage

How to Get Mortgage License in NY

Conclusion

The concept of an open-end mortgage brings a transformative dimension to the realm of home financing.

By providing homeowners with a revolving line of credit secured by their property, this innovative mortgage type empowers borrowers with unparalleled flexibility.

The ability to access additional funds beyond the initial loan amount, coupled with the potential for lower interest costs, grants homeowners the means to address various financial needs, from renovations to unexpected expenses.

However, the advantages of open-end mortgages must be balanced with responsible financial management to avoid overextension.

As the real estate landscape continues to evolve, open-end mortgages stand as a versatile tool that can reshape how individuals navigate their homeownership journey and financial strategies.